Reasons to trust

Strict editing policy focusing on accuracy, relevance and fairness

Created by industry experts and meticulously reviewed

The highest standard for reporting and publishing

Strict editing policy focusing on accuracy, relevance and fairness

Morbi Pretium leo et nisl aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque Nec, ullamcorper eu odio.

Español.

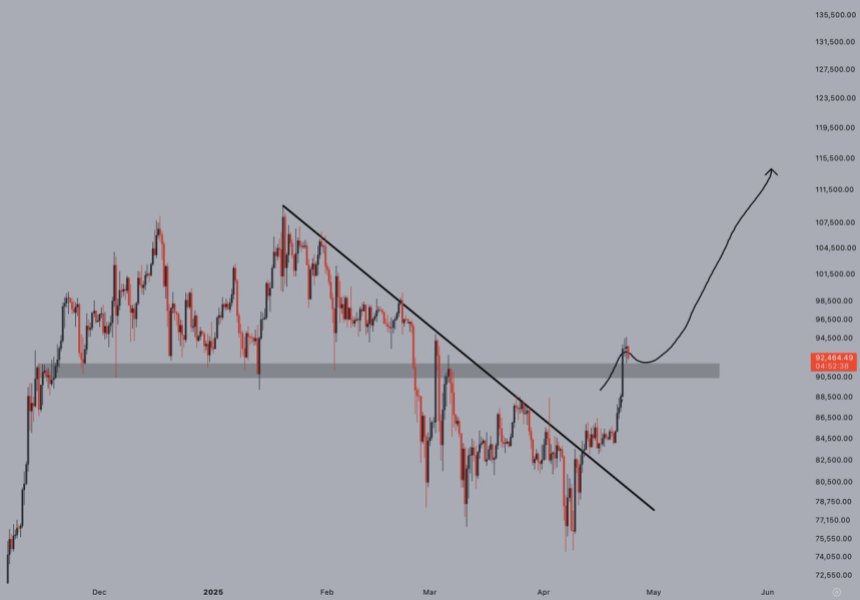

Bitcoin has traded over $90,000, showing signs of new strength despite global tensions and macroeconomic uncertainty continuing to weigh investors’ feelings. After weeks of volatile shaking and bear pressure, the major cryptocurrencies appear to be stable, and some analysts believe this could mark the start of a wider rally in the coming months.

Related readings

Top Crypto analyst Jelle shares insights with price charts and highlights key technology developments. Bitcoin has recovered range drops and has held them so far. This type of price action usually indicates healthy integration and increased buyer trust.

Despite the concerns of a continuing trade war and uncertainty about interest rates, Bitcoin’s resilience offers investors hope. Holding the current range could result in a push stage to a new all-time high as momentum continues. While attention remains due to external risks, many view current setups as a potential bullish inflection point that could shape the next major leg of the crypto market.

When sentiment gets bullish, Bitcoin regains its low range

Bitcoin is currently trading at a critical level after a sharp market impulse has changed emotions overnight. For months, BTC has been stuck in a downtrend that began in January, irritating the bull and seeking deeper corrections. However, with the recent surge in BTC over $90,000, many analysts believe this trend may have ultimately reversed.

However, attention still dominates the wider landscape. The global uncertainty driven by the escalation of trade tensions between the US and China and the escalation of unpredictable macroeconomic signals continues to compare investors’ trust. A single negative development, such as Hawkish Central Bank policy and geopolitical instability, can bring the market back into risk-off mode.

Still, optimism is coming back, especially among technology analysts. Jelle shared an update highlighting that Bitcoin has recovered and retained range degradation. “I’d like to see if you’re really bullish,” he pointed out, emphasizing that a shallow pullback and subsequent strength usually precedes further continuity to benefits.

This scenario suggests that the time for a simple entry is behind us. If this momentum applies, Bitcoin can get back on track to beat the new all-time highs faster than many would expect. The breakout has rekindled hopes for a major bull run, but the next few days will be important in making sure the move is sustainable or another short-lived rally.

Related readings

BTC will hold above $90,000 after collecting the moving average of the key

Bitcoin is trading at $92,500 after a powerful move above the psychological $90,000 level, confirming its bullish momentum in the short term. The breakout also marked a decisive closure of over 200 MA in four hours and EMA. Reclaiming these technical levels indicates a potential change in trends after months of sales pressure and sideways behavior.

With the Bulls in good control, the focus shifts to the $10,000 mark. This is an area that not only carries psychological weight, but also serves as the next important resistance in the rally. Pushing beyond this level could attract new buyers, see broader breakouts and set the potential stage for potential high runs.

Related readings

However, caution is still guaranteed. If Bitcoin fails to maintain momentum and falls below $88,500, it could trigger a consolidation phase or even a larger fix. The current main support, the 88.5K zone, must be held to maintain a bullish structure. As Bitcoin approaches these important levels, the next move could define the short-term direction for both BTC and the broader crypto market.

Dall-E special images, TradingView chart