“The derailment is here.”

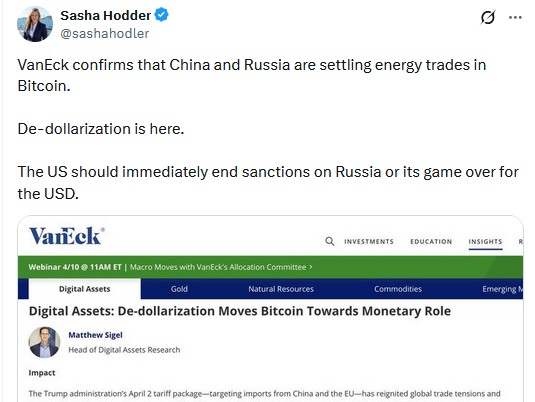

Sasha Hodder, founder and lead lawyer of Hodder Law, a company specializing in cryptocurrency business law founded in 2022, commented on the impact of the Trump administration’s (now suspended) tariffs, as highlighted in an article released Wednesday by Asset Manager Vaneck.

The article “Digital Assets: Derailment Moves Bitcoin towards the Financial Role” was one of the series released on Tuesday by Portfolio Manager on Tuesday, and was tasked with providing “insights” into the multiple current impacts of tariffs.

Founded in 1955, Vaneck is described in the About section of its website, claiming its assets (AUM) figures under management of $113.8 billion as of December 31, 2024.

“… He was one of the first US asset managers to provide investors with access to international markets, and recognized early on the potential for transformation of gold investments, ETFs and digital assets. ”

Written by Matthew Sigel, head of US Digital Asset Research at Van Eck, Insight Piece points out and states Bitcoin as a solution to a country seeking a form of trade settlement independent of the US dollar.

“… Weaponization of trade and financial infrastructure continues to drive interest in neutral settlement rails. …

“China and Russia reportedly have begun to resolve energy transactions for Bitcoin and other digital assets.

“Bolivia has announced plans to use crypto to import electricity. The French energy utility EDF is investigating whether Bitcoin can be mined with the surplus electricity currently exported to Germany..

“These are early signs that Bitcoin has evolved from speculative assets to functional financial tools. Especially in an economy that is considering bypassing the dollar and reducing exposure to the US-led financial systems. ”

No stranger is unofficially expressing what she calls “professional expert opinion.” Hodder’s Wednesday X Post has over 3,000 likes within five hours! I received over 600 reposts, I said in a concise manner.

“Vanek confirms that China and Russia are resolving Bitcoin energy trading. The derailment is here. The US should immediately end sanctions against Russia or finish that game for USD. ”

Hodder is highly approved on the company’s website by many industry experts, including JP Richardson, CEO of Exodus (Wallet) Movement.

According to her LinkedIn profile, Hodder serves as a senior advisor to Exodus.

While being a full-time practice lawyer, she also posts industry updates on navigating YouTube and X’s digital asset regulations.

Explain for Bitcoin newsreaders via direct message about the use of phrasesUSD game over,” Hodder clarified:

“If China and Russia can resolve Bitcoin energy trading, the US dollar will lose its most important function and is the global reserve and settlement currency. It’s not a one-night breakdown, but it’s the beginning of the end of the dollar’s domination over world trade. ”

The same screenshot of Sigel Opinion was further driven within the Bitcoin community and was also reposted by “Coin Story” host Natalie Brunel.

One X user, “DKIRK,” was questioned in her thread.Source of his quote“On Bitcoin settlement for energy trade between Russia and China.

Sigel’s feed requested that user Ricky Rom know as well.

““Reportingly”…Who reported it and where?“

According to Investopedia, a response from Sigel, self-described on his X account, boasting over 40,000 followers, was soon received as a “CFA recovery,” which boasts over 40,000 followers.

Sigel responded with a sigh, quoting perhaps three recent news links.

“I don’t know why this is so difficult.”

The two links he provided are from the well-known news agency Rueters, which illustrate a global scenario.

“Russia is leaning towards cryptocurrency because of the oil trade,” according to sources. and “Bolivia will turn to code due to energy imports in the event of a shortage of dollars and fuel.”

Sigel’s third provided news link was to a big whale and reported in the headline “The French government will open the door to bitcoin mining through EDFs.” According to the article, EDF is a state-owned “energy giant.”

Commenting on Sigel’s feed, Russian user Brian McDonald summed up the situation and said,

“Vanek calls it the first real step into a parallel system.. ”

Bitcoin News reported on the developing multinational exit from Petrodollar dependency in October 2024 featuring Vaneck’s Sigel “BRICS NATIONS EYE Bitcoin is released from the US Dollar: Vaneck.”

The BRICS alliance of the previous five countries (Brazil, Russia, India, China and South Africa) currently includes 10 countries, which account for around 45% of the world’s population.

(Details: This author has published a December 2024 column entitled “World War I Bitcoin.”

Our elections and the Bitcoin industry friendly promise, now the policy of President Trump’s administration, Sigel said that as Bitcoin News said in the fall, countries including Argentina, Ethiopia and the United Arab Emirates are mining Bitcoin…

“Creating additional revenue streams and perhaps more importantly establishing alternatives to the US dollar in international trade.,’

… Similarly:

“This shift is part of a broader strategy among emerging economies to reduce dependence on the dollar, which was the dominant currency of global trade.. ”

The ongoing debate about Hodder’s feed brought up T Bill and the stupidity.

Hodder has expressed her belief in Bitcoin’s future dominant role in global finances, referring to the Trump administration’s recent Stablecoin Act – “…Strengthen control of the US dollar” According to the Forbes headline on March 27th.

Hodder is a tether, and Stablecoins are “… It will support the dollars for the next few years until it breaks. ”

Sigel’s recent report reiterated Hodder’s sentiment and BRICS countries, “”Bitcoin has evolved from a speculative asset to a functional financial tool. Especially in economies that are considering bypassing the dollar and reducing exposure to the US-led financial system. ”